The punch bowl has been given back to the housing market in the form of low interest rates. Mortgage rates are the lowest that they’ve been in 12 months, which is going to have a great effect on this spring selling season. This past week, interest rates on 30-year fixed rate mortgages averaged 4.35%. Towards the end of last year, we were just under 5% on a 30-year fixed. But why is this so significant?

Interest rates are defined as the cost of borrowing money. The American economy heavily depends on financed assets. Cars, Houses, Boats, etc. – Are for the most part, financed. When people can afford to borrow more because interest rates are lower, they have more buying power. If interest rates are low a buyer can afford a bigger/better home in a better neighborhood. Low interest rates also give buyers the confidence that they’re buying a home in a market where prices will either remain to same or grow in the short term. Had the situation been the opposite, where people felt a rise in rates was something that we’d be seeing in the short term, they would hold off on buying a home – because the price of their asset would likely decline in the short term. Rising interest rates are not good for asset prices, because incomes typically don’t change very quickly. In a market where interest rates rise too fast somethings got to give for people to be able to afford what they’re trying to buy. Usually, in that case, the price of the asset is where a concession needs to be made for potential buyers to be able to afford the asset. So, the flow of credit and price at which money costs to borrow (The Interest Rates) – are the most important factor in housing.

Mortgage rates move in tandem with the 10-year U.S. Treasury note. Bond Yields, which decline as the price of bonds rise, were caught in the volatility that we saw at the end of last year. The yields have declined as the Federal Reserve keeps talking in favor of changing the pace at which they reduce the bonds they hold on their balance sheet. The acceleration of debt from Trumps new policies are being financed by the issuance of these bonds. Due to the massive issuance of this significant debt, the excess supply of these bonds could erode the price & demand of these products. However, for now there is more buying than selling of these asset types.

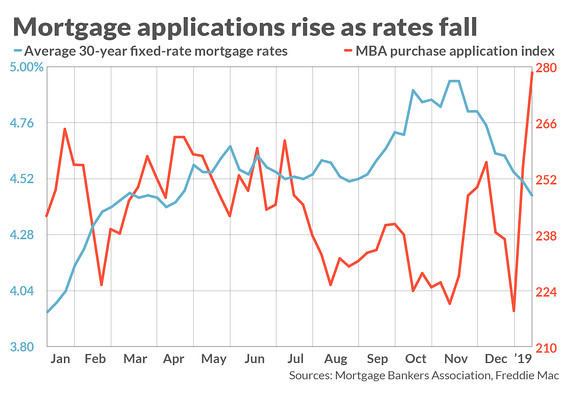

So, to draw this blog to a close, I’d like you to reference the graph below that shows how mortgage applications rise when interest rates fall. This spring we are seeing an extremely favorable market with regards to real estate. Sellers are going to be able to sell their houses for numbers that they desire, and buyers will be able to afford more. Everybody wins. However, we don’t know how long this will last. Remember, just two months ago most people thought we were headed for an economic disaster. Seize the market when market conditions allow you to, and right now it’s looking really good.

The Pesce & Lanzillotta Team, at BHHS Laffey International Realty

Office: 516-888-9711

Email: info@pl-team.com